Jacob Stein

The Fall of Terra Luna

If you pay any attention to Web3 news, you would know about the fall of TerraUSD and its sister coin, LUNA, in May of 2022. Both coins are the brainchild of Do Kwon and his South Korean company Terra Labs. Terra at one point had a $15 billion market capitalization, and a $40 million sponshorshup deal with the Washington National Major League Baseball team. How did such a large Web3 titan fall from grace?

Terra was created with the intention of realizing Bitcoin's fundamental goal– creating a peer-to-peer trustless cash system. Two do this, Kwon created a two-coin system, with one pegged to the U.S. dollar as a stablecoin, and the other tied to that same stablecoin to absorb its volatility through a serious of relational algorithms. Hence, when more people buy TerraUSD (ticker UST), the price stays the same but the price of LUNA goes up. Conversely, when people sell off UST, the price of LUNA goes down. The price of LUNA in 2021 started around $0.66 a pop, but as UST grew to become the fourth largest stablecoin, the price of LUNA propelled to over $100 at its peak in March of 2022.

The balancing of the tokens has to do with a type of arbitrage. The LUNA-UST exchange rate holds a constant of $1, regardless of extraneous factors. When UST goes above $1 due to rising demand, people can bank a profit by transferring $1 of LUNA to $1+ of UST, creating a new token. During the transfer, some LUNA is burned and some is put in the Terra treasury to fund future applications and projects. The supply of UST is diluted with new tokens, bringing the price of UST back down to $1, and raising the price of LUNA by deleting tokens. Similarly, when UST goes below $1, people can bank a profit by transferring it to LUNA, diluting UST and raising the price, and saturating LUNA and lowering the price. This is done through smart contracts and is meant to balance the price of UST at $1, rather than relying upon a Federal Reserve to control the price.

Terra behaves like a represenative governmental body, where decision-making power is allocated based on the number of tokens staked towards the consensus mechanism (PoS). A higher stake yields a higher probability of adding a new block and gaining the rewards, and governance power. The ostensible stability, interoperability, and decentralization of Terra enabled several financial services without the need for a central authority, including lending, borrowing, insurance, investing, and charity.

The Terra ecosystem contains several important platforms, programs, and applications. We will only focus on one of them, though, with significant relevance to the eventual crash of UST and LUNA. The Anchor protocol essentials functions like a bank account. UST holders can deposit their tokens into the contract, and earn a 20% yield. Interest payment and staking rewards from collateral vested by borrowers is paid to the lenders with tokens staked in the contract. If it sounds too good to be true, it probably is; more on that later.

UST grew in popularity because of its truly decentralized nature and stability derived from computer algorithms. UST also performed well during high volatility while other stablecoins did not whether the storm as well. Algorithm-based stablecoins are a relatively new concept, with DAI being another important one. They have not yet stood the test of time, and have been deemed "inherently unstable" and thus not fit to perpetually survive instability. Decentralized stablecoins inherently have no centralized capital backing it, and are thus reliant on other sources of stability. In the case of algorithm-backed coins, if the design is flawed and can be exploited, there is no backdrop for the coin to fall on.

With all of this preliminary information in mind, we can begin exploring the events and context that led to the crash of the token.

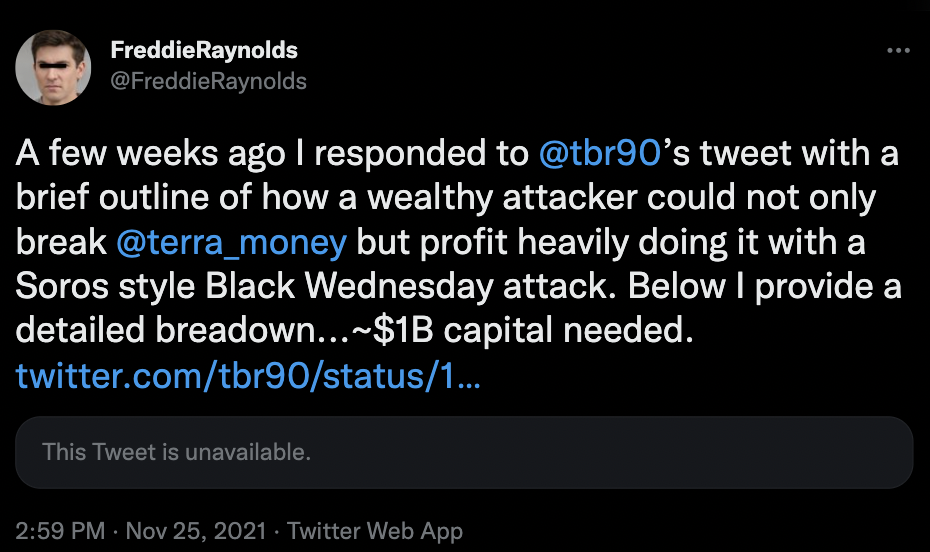

November 25th, 2021 - A Twitter used under the handle @FreddieRaynolds outlines in a Twitter thread how a billionaire could abuse exchange rates, short LUNA, and rinse and repeat to make an enormous profit and cripple the protocol. Such an attack resembles the shorting of the British pound by George Soros on Black Wednesday of 1992. The thread is still publicly available and goes into further detail if you want to find it.

November 28th, 2021 - Do Kwon gracefully dismisses @FreddieRaynolds attempt as impossible, inviting billionaires to challenge him.

January 19th, 2022 - Do Kwon announces the Luna Guard Foundation (LFG), a fund dedicated to holding reserves in the event of high volatility, and to investing in growing projects within the ecosystem.

February 22nd, 2022 - The LFG raises $1 billion via LUNA tokens to buy bitcoin to put in the reserve, with funding led by Three Arrows Capital (also now defunct and bankrunpt).

March 23rd - 30th, 2022 - The LFG purchases over $1.5 billion worth of bitcoin to prop up LUNA in the event of a crash.

April 7th - 14th, 2022 - The LFG gains another $1 billion worth fo tokens via purchases and a gift from Terraform Labs.

May 7th, 2022 - An anonymous user swaps 85 million UST for 84.5 million USDC, causing some volatility.

May 8th, 2022 - LFG allocates $750 million to absorb impending volatility, and another $750 million to rebuy bitcoin to restock reserves when the price dips again. Do Kwon jokes about UST depegging on Twitter.

May 9th - The Anchor protocol loses a third of its staked value, plummeting $5 billion. Anchors native token plunges 35%, and UST falls to 35 cents.

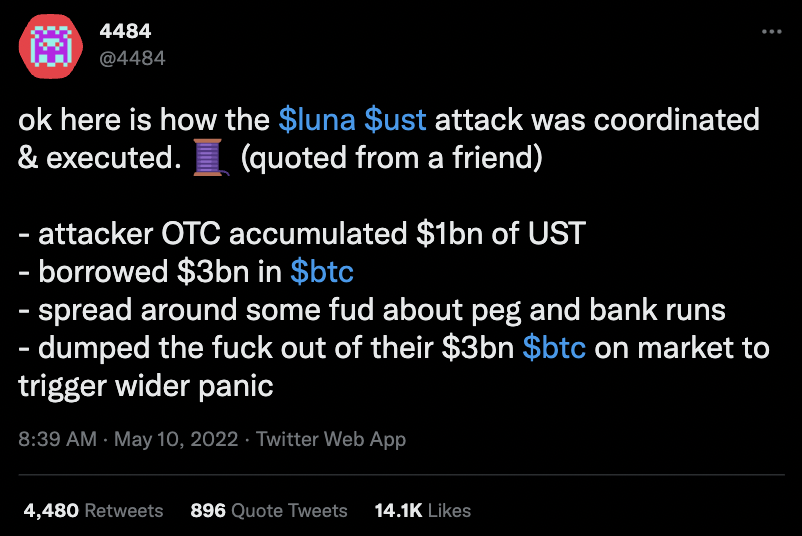

May 10th - Amateur Twitter sleuths hypothesize how a wealthy attacker could have abused perfectly aligning circumstances to make a huge profit. The attacker borrowed billions of dollars in bitcoin, and sold them, bringing the price of Bitcoin down. The attacker had also accumulated $1 billion in UST, then bought out the liquidity of Curve, a popular stablecoin exchange. The attacker then sold their UST on Binance, depegging UST with an oversaturation of UST tokens. At this point, the LFG had an enormous position on Bitcoin to absorb volatility, and they begin selling of bitcoin to asborb the depeg created by the attacker selling UST on Binance. This brings the price of Bitcoin even lower, which means the LFG needs to sell more to absorb UST volatility. People realize this and begin panicking, selling off both bitcoin and UST, adding congestion to the blockchain. The LFG realizes what is happening, and stops selling off bitcoin to cover the UST depeg, and they let UST crash and burn. Widespread panic and selling keeps the price of bitcoin down. The attacker rebuys bitcoin at a lower price, and returns the loan, completing the short sell. By letting UST and LUNA crash and burn, Do Kwon and the LFG basically let average investors absurb the brunt of the attack. Thus, both Do Kwon and the attacker are culpable for the massive losses, leading some to speculate that it was an inside job. See the Twitter threads under @4484 and @OnChainWizards for a more in-depth explanation.

May 11th - 13th, 2022 - The events of days prior trigger massive sell-offs. Value locked within the Anchor protocol lose $11 billion in value. Do Kwon is learned to have previously started another failed stablecoin called Basis Cash. LUNA falls 96% to under 10 cents in the wake of unabsorbed volatility. The Terra blockchain is halted, exchanges delist LUNA, and plans for remediation begin.

Nothing of great importance happened after that. The South Korean police began looking into the whole situation and Do Kwon, because the crash affected over 260,000 South Koreans and erased billions of dollars in value. Do Kwon proposed a hard fork of the chain on which no stablecoin existed, and was approved by validators. Terra 2.0 is currently being built, but its too early at the time of writing to determine its future.

The moral of the story is do your own research. The more important moral is that the Web3 scene is crazy and unregulated. When you engage with it, you assume a large risk, and its something you need to accept. Very few people have the experience and working knowledge of the space to forsee such an attack. Even those who predicted it, like @FreddieRaynolds, have no capacity to stop it, so its just a reality to live with. Stay safe.

Jacob Stein

Hello! I'm a junior at Boston University studying computer science and political science. I have a strong interest in blockchain technology use-cases and implementation. This blog is just meant to document and explore my areas of interests. Feel free to comment, or contact me at jmstein@bu.edu.